Can Cryptocurrency Revolutionize the Rituals of Money?

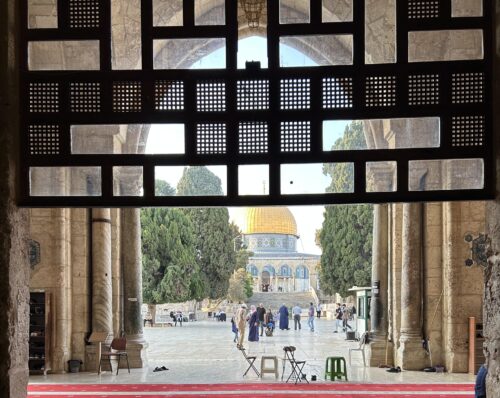

Objects—pieces of paper, coins, lumps of precious metal—may serve as currency and represent specific monetary values, but what underpins the exchange of money is trust. We trust that our money will retain its value, that others will be willing to trade for it, and that it will still be in the bank when we come back for it. In recent years, cryptocurrency has emerged as a disruptive alternative to traditional money. Fundamentally, cryptocurrencies like bitcoin and ethereum function by replacing trust in banks and the government with trust in digital cryptography.

Instead of relying on a bank or a third party to mediate the exchange of money for goods or services, cryptocurrencies use an encrypted, decentralized digital ledger called a blockchain to secure transactions and to restrict the creation of more units of the currency. As an anthropologist, it’s fascinating to watch the new transition of money into cryptocurrency—an evolution underpinned by a larger cultural narrative about what we value and who we trust.

Anthropologists have long been intrigued by mediums of exchange. As British social anthropologist Mary Douglas once wrote, “Money is only an extreme and specialized type of ritual.” Modern culture abounds with meaningful customs, beliefs, and terms about money. We say “blood money” for money obtained at the cost of a life or “dirty money” for that accrued from illegal or immoral transactions. An individual can either be “filthy” rich or “dirt” poor. For most of us, the emotional response to a publicly declined credit card lies somewhere between embarrassment and shame; in fumbling a ritualized exchange of value, we often feel we have somehow violated the social order and perhaps compromised our trustworthiness in the eyes of our peers. The relationship between money and moral character is a consistent theme in cultural dialogues about money, and it extends beyond the individual to financial institutions and the governments that manage them.

We may be on the brink of a radical shift in our economic system. As a global economic superpower and the home of many of the largest tech companies in the world, the United States stands to have a far-reaching impact on the future of cryptocurrency. American cultural values—from support for the underdog to adulation of the frontier explorer—seem to be the precipitating source of that transformation and will likely shape the new rituals of economic exchange.

Contrary to popular belief, money was probably not developed to replace a bartering economy. Instead of bartering, some hunter-gatherer communities exchanged resources as gifts, with the expectation of future reciprocity. In gift economies, wealth was measured in trust and personal relationships, with direct trade reserved for strangers.

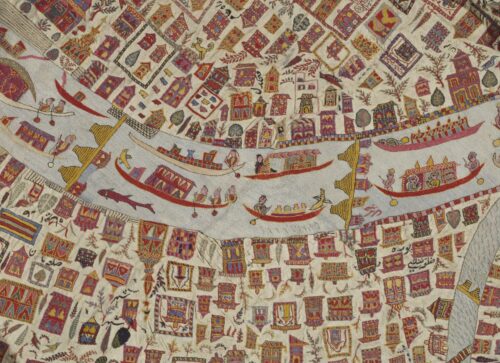

As societies grew in size and social complexity, however, it became necessary to record and track the exchange of resources. The earliest records of debt and credit accrued from exchange were inscribed on clay tokens from 8000 B.C. Mesopotamia. Units of account were also sometimes measured in commodities, like obsidian or cattle, that had inherent value due to their scarcity or utility.

Other societies used more unusual items. On the Pacific island of Yap, residents traditionally used stone wheels up to 4 meters in diameter as markers of value. These stones, called fei (or rai), were often too big to move, but they still changed hands. In the event of an outstanding balance accumulated through trading fish, coconuts, pigs, or sea cucumbers, ownership of the fei could be transferred as a means of tracking credit. Economic trust was dispersed throughout society, with participants only having to trust that the collective would continue to recognize the value of a fei.

But such resources are often tricky to source, impractical to carry, and difficult to regulate. Thus, over the centuries, money has evolved from gold and silver coins in seventh century B.C. Lydia (in modern-day Turkey) to paper bills, digital accounts, and coins of nickel, copper, and zinc. Instead of using commodities as money, most countries use a fiat currency, or a currency that has value only by government decree. In other words, a US$20 bill is objectively just a piece of cotton fiber, more durable than Monopoly money but equally useless without the Federal Reserve and U.S. Department of the Treasury to validate its worth.

Today, the practice of storing, managing, and transacting with money and currency has reached a staggering level of complexity. For the average person, the nuances of economics are opaque beyond the boundary of personal finance. And so, we put our trust in financial institutions. We trust that our money is indeed ours, even if we do not hold it in our hands. We trust that banks will look after our money and keep it safe. We trust that our financial advisers have our best interest at heart. We trust in the value of saving money for retirement. Fundamentally, we trust that those who have been given the authority and power to manage our money will do so with integrity.

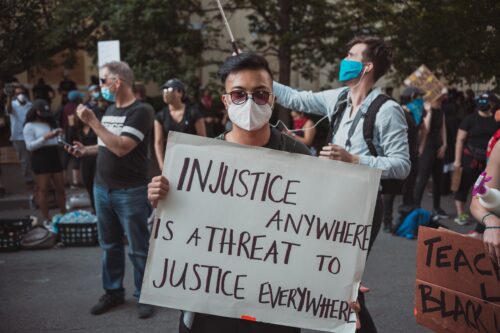

Or, at least, we try to. The subprime mortgage crisis of 2007 and the subsequent initiation of the Troubled Asset Relief Program, or bailout program, fueled global protests lambasting large banks as greedy and corrupt. In his book The Social Life of Money, sociologist Nigel Dodd explains that the “nexus of mutual obligation upon which money depends has been eroded by a system that allows immensely profitable banks to remain solvent at the public’s expense.” This public trust has been further undermined by seemingly interminable revelations of nefarious banking practices: Wells Fargo employees secretly created millions of accounts without authorization from their customers, foreign exchange traders from at least six global banks colluded to manipulate the market and profit enormously at their clients’ expense, and HSBC admitted to laundering hundreds of millions of dollars for Mexican drug cartels. In that dearth of integrity, cryptocurrencies have emerged as an intriguing alternative to a flawed financial industry.

Bitcoin, the original cryptocurrency, seeks to do for money what the internet did for information—expand access, decentralize ownership and management, and limit mediating third parties. Instead of a bank keeping a record of your transactions, this information is encrypted and recorded on a distributed ledger, or blockchain. A copy of the blockchain is then dispersed to all users of the cryptocurrency. The open source nature of Bitcoin makes fraudulent tampering with the transaction record, or “double spending,” nearly impossible. Cryptocurrency evangelists claim that the technology is “trustless,” arguing that its integrity is preserved by an incorruptible ledger instead of a government or institution. In reality, trust has not been removed from the equation but shifted from faceless institutions to blockchain technology.

In the wake of all this connectivity has come a tidal wave of new ways to use money.

Transacting without direct oversight or mediation from banks has happened before, though for different reasons. The Associated Banks in the Republic of Ireland were closed for six months by strike action in 1970. Without a bank through which to clear checks, there was nothing preventing payees from writing bad checks. Anyone accepting a check was doing so based on trust that the check would not bounce when the banks reopened. Despite the risk involved, billions of pounds were transacted. As macroeconomist Felix Martin explains in his book Money: The Unauthorized Biography—From Coinage to Cryptocurrencies, this spontaneous, personalized credit system succeeded thanks to the close-knit nature of Irish communities. In many cases, transactions took place between acquaintances. In instances where the payee and the payer were unknown to one another, local pubs and stores were able to leverage familiarity with their customers to endorse the creditworthiness of a check.

A similar situation occurred in the U.S. during the Great Depression. Following the 1929 stock market crash and a series of bank failures, Americans across the country rushed to withdraw their cash from banks, leading to a shortage of bills. Without any cash for everyday transactions, citizens developed an informal system of IOUs, along with an alternative paper currency called scrip. Iowa was at the forefront of this experiment, even going so far as to pass legislation supporting the use of scrip in counties across the state.

Hyperlocal currencies, such as the Ithaca Hour, still exist in the U.S. today; they are intended to reduce dependence on transnational corporations and bankers in favor of community trading and local commerce. Also in favor of reducing dependence on bankers are self-proclaimed “gold bugs,” investors who consider the value of commodities like gold to be more secure than fiat currencies.

Although cryptocurrency is a global phenomenon, the intersection of low institutional trust with American cultural values has yielded an exceptionally warm welcome for cryptocurrencies in the U.S. The very idea of taking power out of the hands of financial institutions and giving it “to the people” appeals to American ideals of fairness and equality. It harkens back to classic American heroes and morality tales: the cowboy, exalted for braving new frontiers on the fringes of society; the superhero, pursuing justice outside of a broken system; and, of course, the underdog. The American cultural narrative has cast bitcoin as the scrappy, self-righteous “us” in opposition to the all-powerful, opaque, and immutable “them.”

Of course, the U.S. dollar is still one of the most powerful currencies in the world, and it is far easier to buy most goods and services with U.S. dollars than with cryptocurrency. In other countries, however, the distinction is not so clear. Rapid inflation and political instability have made cryptocurrencies a comparatively sound store of value in Venezuela. Cryptocurrency has gained a similar foothold in countries such as Nigeria and Zimbabwe, where the national currency is volatile or unreliable.

Trust in cryptocurrency is far from absolute, however, and with good reason. The value of cryptocurrency is susceptible to wild fluctuations; in 2017, the value of bitcoins shot up 10-fold between April and December, and then plummeted to half its peak value over the next three months. In 2010, a developer bought two pizzas for 10,000 bitcoins; today those coins would be worth more than US$74 million dollars. People worry about the long-term viability of a technology still in its infancy: Will the increasing energy demands of operating a blockchain network drive it into the ground, or will its security be breached? Will cryptocurrency enable criminal activity? Can it be regulated without compromising its decentralized structure?

One of the most interesting questions for anthropologists is how cryptocurrency will shape the cultural symbolism and rituals surrounding money. Digital technology has already transformed how we experience our social worlds. In a now famous Newsweek article from 1995, author Clifford Stoll detailed all of the reasons why the internet was going to fail. He argued that “computers and networks isolate us from one another” and the internet was where human contact was “relentlessly devalued.”

But instead of failing, the internet has become a new frontier of social interaction, complete with subcultures and languages, governed by social expectations, customs, and conventions. In the wake of all this connectivity has come a tidal wave of new ways to use money, and the evolution of cryptocurrencies around the globe has set the stage for a redefinition of the social rituals of the financial world as we know it. If cryptocurrency is to money what the internet was to information, we can expect a rocky transition that is likely to transform our lives in unexpected ways.